Japanese exporter-heavy equity markets also got some broad support from a weaker yen versus the dollar. However, the outlook for the currency pair looks murky, with investors watching Bank of Japan Governor Kazuo Ueda’s testimony in parliament after last month’s surprise rate hike.

Market participants are also looking forward to U.S. Federal Reserve Chair Jerome Powell’s keynote speech at the annual Jackson Hole symposium later in the day.

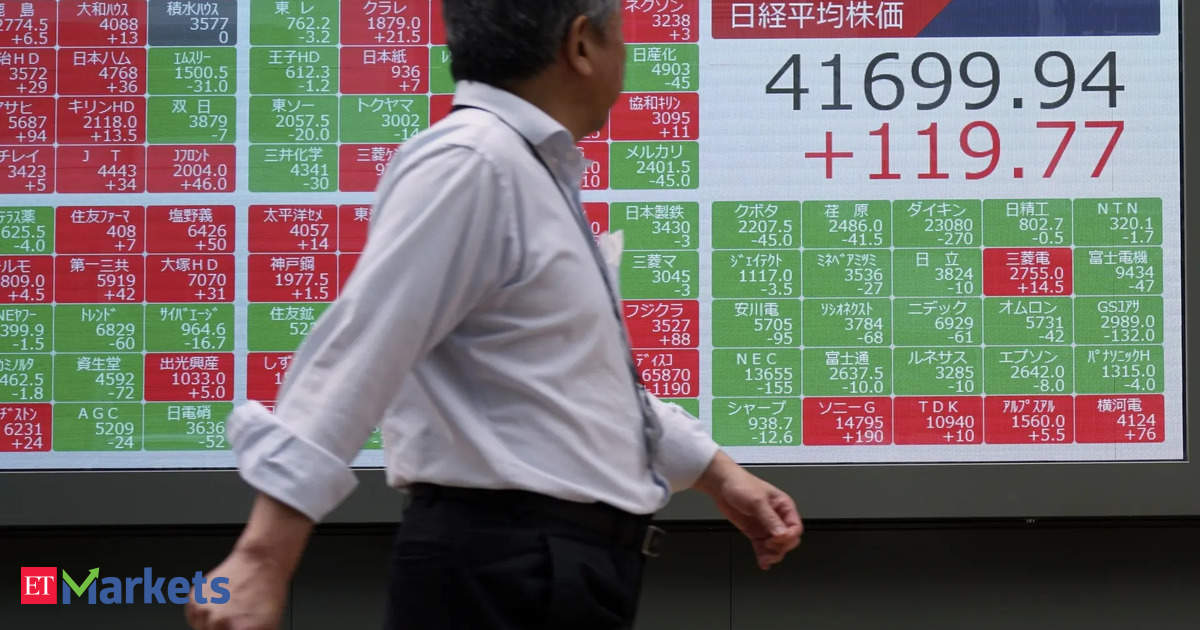

The Nikkei rose 0.2% to 38,288.79 by 0008 GMT, while the broader Topix climbed 0.32%.

Pharma was among the top gainers among the Tokyo Stock Exchange’s 33 industry groups, with a 1% rise. It climbed 1.56% on Thursday. Sumitomo Pharma gained 2%, while Chugai Pharmaceuticals jumped 2.9%. Electronics makers Sharp Corp was the Nikkei’s biggest percentage gainer, soaring more than 7% following a report that SoftBank Corp was in talks to make a 100 billion yen ($683.53 million) investment. SoftBank shares were little changed. At the other end, chip-testing equipment manufacturer Advantest was the Nikkei’s biggest decliner both in percentage and points terms, dropping more than 2%.

Chip-making machinery giant Tokyo Electron slipped 0.8%.

($1 = 146.3000 yen) (Editing by Subhranshu Sahu)

Source link