- About Us

- Above ₹500 Holdings

- Algo Trading Auto Tradding with Ganesh Gandhi

- Angel Investor

- Apply Design

- Apply Document

- Apply For JV

- Apply Loan

- Bank Account

- Blog

- Bond Invest

- Building For Sale

- Business Consult

- Business Document

- Business Loan

- Car Loan

- Career

- Career Form

- Choose Broker

- Cibil Score

- Commercial Design

- Commercial Design

- Commodity Trading

- Contact

- Container Projects

- Credit Card

- Crypto Trading And Investment

- Digital Signature

- Disclaimer

- Document pricing

- Downlaod

- Elementor Elements

- Equity FO Follow

- Equity Training

- Equity Training (Paid)

- EXIM INQUIRY

- Exim Training (Free)

- Export Training (Free)

- Fashion & Accessory

- Finance / Loan

- Fixed Deposit

- For Complaint

- For Entrepreneur

- Forex Trading

- Frequent Asked Questions (FAQ)

- GAGA Homes – Articles

- GAGA HOMES (2d & 3d Design Services)

- GaGa Training

- GAGA WEALTH

- Home

- Home Loan

- IMPORT-EXPORT

- Index Prediction

- Intraday Demo

- Investors

- Joint Venture

- Land For Sale

- Life Investment

- List of Entrepreneurs

- List of Investors

- Live Share Market Chart

- Make Payment

- Market News

- Mentor Appointment

- MF Demo

- MF Paid Advice

- MF REPORT

- Mortgage Loan

- MSME Loan

- Mutual Fund

- My Holdings

- OTHER SERVICES

- Our Gallery

- Our Groups

- Payment Cancel

- Payment Failure

- Payment Success

- Personal Loan

- Personal Loan

- Physical to Demat Shares

- Plot for Sale

- PMS REPORT

- PORTFOLIO MANAGEMENT SERVICE

- Privacy Poilcy

- Pure gold for Sale

- Pure Silver for Sale

- Realty Articles

- Realty Inquiry

- Refund and Returns Policy

- Return Policy

- Share Market

- Share Training (Free)

- Shop

- Site Map

- Social Media

- Social Responsibility

- Terms & Conditions

- Unlisted Shares

- Upstox Demo

- USA & Canada Market News

- USA Stocks & ETF

- Vaasthu Design

- We Certified

- We Import

- Web Design

- What is Joint venture

- Why Us ?

- ₹10 Holdings

- ₹100 Holdings

- ₹25 Holdings

- ₹250 Holdings

- ₹500 Holdings

- 27/02/2026

- by GAGA

- Share Market

#INKEL IPO: You Should Buy Before IPO (unlisted Share) – Should You Invest Now? GAGA Share in Tamil

Are you looking for a promising investment opportunity? Discover the potential of Inkel unlisted shares in this comprehensive video. We’ll delve into the reasons why Inkel is a strong contender for investment and provide insights into its upcoming IPO. Don’t miss out on this valuable information! A brief overview of Tata Capital and its business…

READ MORE- 11/11/2023

- by GAGA

- Business Ideas

லாபகரமான சலவைத் தொழிலைத் தொடங்குங்கள் | Laundry Business Step-by-Step Guide and Business Plan

Welcome to GAGA TV – Business Channel! In this video, we’ll guide you through the process of starting a successful laundry business in India. From market research and legal formalities to equipment selection and marketing strategies, we’ve got you covered. Follow our step-by-step guide and business plan to launch your own lucrative laundry venture. 🚀…

READ MORE- 07/02/2023

- by GAGA

- Gaga Homes

Temporary Shed #industrialsheds #warehouse Ganesh Gandhi GAGA Homes GAGA INDIA

Website : https://www.gagatv.net Telegram Group : https://telegram.me/gagatvindia Facebook : https://www.facebook.com/gagatvindia/ by GAGA HOMES https://mrgaga.in/gaga-homes https://www.facebook.com/GAGAhomesin/ We Undertake #2d3dHomeDesign #interiordesign #exteriordesign #elevation 2d 3d home design ideas, 2d 3d house plans, 3d home design 2 bedroom, 2d 3d house design, 3d home plan design, 3d home design floor plan, 3d home design free, 3d home ideas…

READ MORE- 05/08/2022

- by GAGA

- Business Ideas

IMPA B2B | Chennai | Present | Kunrathur Baskar | Director of GAGA INDIA | TMNJA Sengunthar Trust

Website : https://www.gagatv.net Telegram Group : https://telegram.me/gagatvindia Facebook : https://www.facebook.com/gagatvindia/ IMPAP B2B Connect – Chapter 4 in Chennai Review by Kundrathur Baskaran Director of GAGA India Trustee of T.M. Nagalingam & Jayalakshmi Ammal Sengunthar Trust source

READ MORE- 27/02/2026

- by GAGA

- Business Ideas

#2022_Business_Idea_In_Tamil | Top 5 Latest Business Idea | Ganesh Gandhi | GAGA INDIA

Website : https://www.gagatv.net Telegram Group : telegram.me/gagatv_net Facebook : https://www.facebook.com/gagatvindia/ #2022BusinessIdea #2022BusinessIdeaTamil #2022BusinessStrategy Presentation, Done By : Ganesh Gandhi (Founder of GAGA INDIA) https://mrgaga.in CATEGORIES: 00:00 Introduction 01:50 Idea-1 (E-Bike Service Center) 04:32 Idea-2 (E-Bike Accessorie Shop) 06:00 Idea-3 ( HR Consultant for online Passout) 06:52 Idea-4 ( Cycle/Bike Home Service) 08:08 Idea-5 ( Business…

READ MORE- 27/02/2026

- by GAGA

- Business Ideas

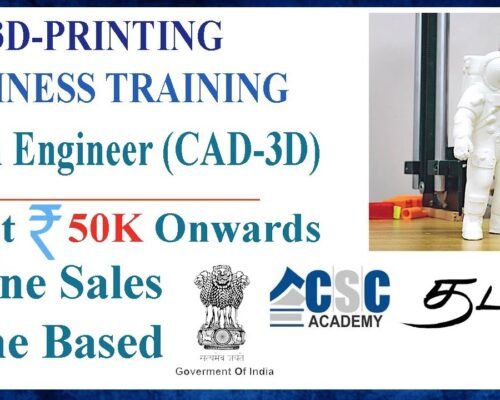

3D Printing Businees Idea | Training | Machine | Loan | CSC Academy | Government of India l GAGA

https://mrgaga.in/blog/business-ideas/3d-printing-course-business/ About Us : https://mrgaga.in/whoami.html Facebook : https://www.facebook.com/gagaindia/ Our Services: Business Support – https://mrgaga.in/consult/ Insurance – https://mrgaga.in/general Finance / Loan – https://mrgaga.in/loan Documentation – https://mrgaga.in/doc Digital Signature – https://bit.ly/30cuMfT Online Job – https://mrgaga.in/task Share Market – https://mrgaga.in/share Mutual Fund – https://mrgaga.in/mf Wealth – https://mrgaga.in/inv Realty – https://mrgaga.in/realty E Courses – https://mrgaga.in/training E Shop – https://mrgaga.in/shop…

READ MORE- About Us

- Above ₹500 Holdings

- Algo Trading Auto Tradding with Ganesh Gandhi

- Angel Investor

- Apply Design

- Apply Document

- Apply For JV

- Apply Loan

- Bank Account

- Blog

- Bond Invest

- Building For Sale

- Business Consult

- Business Document

- Business Loan

- Car Loan

- Career

- Career Form

- Choose Broker

- Cibil Score

- Commercial Design

- Commercial Design

- Commodity Trading

- Contact

- Container Projects

- Credit Card

- Crypto Trading And Investment

- Digital Signature

- Disclaimer

- Document pricing

- Downlaod

- Elementor Elements

- Equity FO Follow

- Equity Training

- Equity Training (Paid)

- EXIM INQUIRY

- Exim Training (Free)

- Export Training (Free)

- Fashion & Accessory

- Finance / Loan

- Fixed Deposit

- For Complaint

- For Entrepreneur

- Forex Trading

- Frequent Asked Questions (FAQ)

- GAGA Homes – Articles

- GAGA HOMES (2d & 3d Design Services)

- GaGa Training

- GAGA WEALTH

- Home

- Home Loan

- IMPORT-EXPORT

- Index Prediction

- Intraday Demo

- Investors

- Joint Venture

- Land For Sale

- Life Investment

- List of Entrepreneurs

- List of Investors

- Live Share Market Chart

- Make Payment

- Market News

- Mentor Appointment

- MF Demo

- MF Paid Advice

- MF REPORT

- Mortgage Loan

- MSME Loan

- Mutual Fund

- My Holdings

- OTHER SERVICES

- Our Gallery

- Our Groups

- Payment Cancel

- Payment Failure

- Payment Success

- Personal Loan

- Personal Loan

- Physical to Demat Shares

- Plot for Sale

- PMS REPORT

- PORTFOLIO MANAGEMENT SERVICE

- Privacy Poilcy

- Pure gold for Sale

- Pure Silver for Sale

- Realty Articles

- Realty Inquiry

- Refund and Returns Policy

- Return Policy

- Share Market

- Share Training (Free)

- Shop

- Site Map

- Social Media

- Social Responsibility

- Terms & Conditions

- Unlisted Shares

- Upstox Demo

- USA & Canada Market News

- USA Stocks & ETF

- Vaasthu Design

- We Certified

- We Import

- Web Design

- What is Joint venture

- Why Us ?

- ₹10 Holdings

- ₹100 Holdings

- ₹25 Holdings

- ₹250 Holdings

- ₹500 Holdings